The Finance minister in his Budget Speech on Feb-01-2017, revised the Cost Inflation Index used by the Indian Income Tax Department to calculate Long Term Capital Gains Tax with Indexation benefit. The revision was shift in base year from 1981 to 2001. What does this mean ? This means any “asset” as defined by the Indian Income Tax department and which comes under the purview of Long Term Capital Gain [For Example – Real Estate] and if acquired before 2001, then for the purpose of determining the Indexed Cost of Acquisition, the base year henceforth will be 2001.

Let us illustrate with an example. Suppose you bought a Plot of Land in 1980 for Rs 10,000. You plan to sell this Plot of Land in FY 2017-18. Let your selling Price be Rs 50 Lakhs. So what is the Long Term Capital Gain you are liable to pay on the same ?

1. What is the Indexed Cost of Acquisition of this Plot of Land in 2001, the new base year ? This will be determined by the Government Valuation or Valuation Certificate Provided by a Registered Valuer in that City. Let us assume it to be Rs 4,00,000 in 2001.

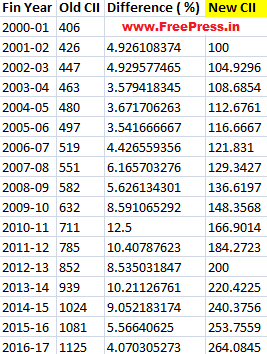

New Cost Inflation Index Table for FY 2017-18

The Government has not year released the table. However, taking 2001 as base year and already Published Values till FY 2016-17, we extrapolate [difference in percentage of old values added to 100 in 2001-02 which is the new base year] the same data and arrive the the following table.

Update:For FY 2017-18 which means the AY will be 2018-19, Cost Inflation Index as Announced by CBDT is 272.

Indexed Cost of Acquisition = Price in the Year of Purchase or Base Year * [ CII in FY 2017-18 / CII in Year of Purchase or Base Year]

In our Case the Indexed Cost of Acquisition = 4,00,000 * 272 / 100 = 11,16,000.

Long Term Capital Gain = Selling Price – Indexed Cost of Acquisition = 50,00,000 – 11,16,000 = Rs 38,84,000

We couldn’t wait until the Government published the new CII Index. We used logic and have arrived at the same. If the Government releases something different, then it will be hard to digest why it did so. Let us wait and watch.

Update

Historical Cost Inflation Index and the Corresponding Inflation is Updated Here

Has the Central Govt. announced the Cost of Inflation Index for the year 2017-18, and if yes can you give the figure pl.?

Cost Inflation Index ( New ) which is published is a great help. I appreciate it.

Has the Central Govt. announced the Cost of Inflation Index for the year 2017-18, and if yes can you give the figure pl.?