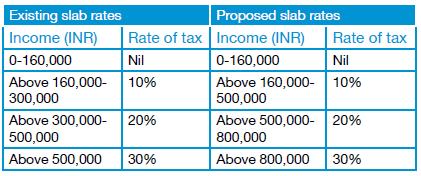

Here are the new Income Tax Rates for Indian Citizens for Financial Year April-1st 2010 to March-31st 2011. [See Chart Below]

In case of resident women (below 65 years of age) and resident senior citizens, the amount of INR 160,000 shall be replaced with INR 190,000 and INR 240,000, respectively. The proposed changes in tax slabs would result in (maximum) savings of INR 51,500.

Sir,

please give me the slabs of I.T. Rate of Partnership Firms’s for the financial year 2010-11

please give me the slabs of I.T rate of Partnership firm’s for the financial year 2010-11 my cell phone no.9948087758

Flat 30% + all other CESS etc.. So what you do is take Salary from the P’ship firm. Then the Salary will be taxed in your individual A/C according to Slabs. Apply the same rul to other partners as well.